An experienced team

Our experienced team

Events that influenced us most

Raj Basra

Chief Investment Officer, Managing Director

Raj is primarily responsible for the Tacit investment philosophy and process. He has nearly 20 years’ investment experience gained in senior roles at Barclays Wealth and Deutsche bank.

Events that influenced us most

Global financial crisis, 2008

The impact leverage had on investment and draining of liquidity from all assets makes this a crisis never to forget. The nature of market participants has changed and this leads to very violent swings in asset prices around an economic event. In 2008 the immediate economic picture did not deteriorate materially, but asset prices moved in a geared fashion based on money flows and fear. This leverage is still evident in the system today and asset price behaviour is impacted by it.

Roy Swain

Investment Director

Roy is responsible for ensuring that our clients’ requirements are at the centre of the Tacit investment process at all times. He has over 30 years’ investment experience gained in senior roles at Deutsche Bank and Societe Generale Investment Management.

Events that influenced us most

Black Monday, 1987

Too many private client investors were encouraged by the popular press and privatisation campaigns to expect to make a fast buck, but investing in stock markets should always be long-term. Investors should always build in a suitable buffer to absorb losses and then sit tight in the teeth of a gale because the problem with bailing out is that you can never be sure when to get back in again.

Leigh Stephens

Investment Director

Leigh has over 30 years’ experience of working within the discretionary fund management industry. He has had divisional and managing investment director roles with private wealth investment organisations, including Deutsche Bank Wealth, HSBC Private Bank and Close Brothers Asset Management. He is a Fellow of the Chartered Securities Institute and of the Chartered Management Institute.

Events that influenced us most

Big Bang, 1986

In my view this was a pivotal time for the City of London and one that resonates strongly with me having joined the City in the summer of ’86. “Big Bang” changed the face of the City of London in one fell swoop through deregulation, making it a financial capital to rival New York. This revolutionary change created one of the most competitive international marketplaces globally, allowing greater competition, mergers and takeovers and an open marketplace to international banks.

Kypros Charalambous

Investment Director

Kypros has lead responsibility for portfolio management at Tacit. He has over 25 years’ experience gained in senior roles at Barclays Wealth and Deutsche Bank.

Events that influenced us most

Dot-com bubble, 1997-2002

This was a lesson in how money flows and momentum can drive returns for a long period but the fundamental value of an investment is what ultimately matters. Investments can trade away from their fair value for extended periods but will revert to their long-term value at some point in every investment cycle.

Paul Wharton

Investment Director

Paul has over 25 years’ investment experience gained as an economist, strategist and fund manager. He served as a Director, Head of Portfolio Management (UK) and Chief Investment Strategist (UK) at Deutsche Bank UK PWM and also sat as a permanent member of Deutsche Bank’s Global Investment Committee. Prior to joining Deutsche Bank he was a member of the Asset Strategy Group at Societe Generale.

Events that influenced us most

Bond market crash, 1994

The events of 1994 taught me a number of key lessons. Risk is not always in a place where the consensus thinks it is. Any asset, however “safe”, is risky if bought at the wrong price. Recognise that leverage is hugely powerful in an upswing , utterly toxic in a downswing. Don’t buy what you don't understand or buy “time-limited” investments and don’t be a forced seller – always match the duration of your investments to the duration of your liabilities.

William Jensen

Director

William has over 30 years’ investment experience gained in senior management roles at Gerrard Limited and Barclays Wealth and has spent the past 10 years in the role of Estates Bursar at Exeter College, Oxford.

Events that influenced us most

Black Wednesday, 1992

If we learned one thing from Black Wednesday, it is that central banks or governments have limited power to manipulate investment markets. It was a reminder that exchange rates cannot be pegged indefinitely at a valuation that does not reflect the underlying economy and competitiveness of that economy. The value of a currency is dictated by buyers and sellers based on their need or willingness to own a currency.

Peter Bickley

Consultant Economist

Peter has over 40 years’ investment experience gained as an economist, strategist and fund manager. His previous roles include Chief Strategist (UK) at Deutsche Bank and Chief Economist at Tilney Investment Management.

Events that influenced us most

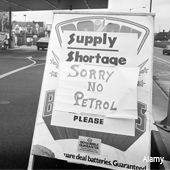

Oil crash, 1974

It taught me that herd mentality is capable of driving markets to extremes beyond any rational limit, whether up or down, and that when an asset class is totally shunned by everyone it’s probably as attractive as it will ever be. When the penny drops, the snap back will be unpredictable and so rapid that the unprepared can never catch up. In short, it taught me to be a contrarian investor.

Jamie Meyer

Investment Consultant

Jamie Meyer has 25 years of industry experience in banking and wealth management, with over 10 years spent in Singapore servicing international clients, returning to the UK in 2021. He started his wealth management journey with the founding members at Tacit at Deutsche Bank before the GFC.

Events that influenced us most

Covid-19 Pandemic, 2019

The one event that had a profound impact was the Covid 19 pandemic. Living in Singapore and being impacted by its draconian safety rules and lengthy quarantines made him re-evaluate the value of proximity to extended family and living in one's place of birth vs being a foreigner.