Share this post

The Illusion of Protection

August, 2025

The theoretical appeal of hedge funds has always been compelling: uncorrelated returns, downside protection, and sophisticated strategies that promise to navigate any market condition. But for many investors, the lived reality has been quite different.

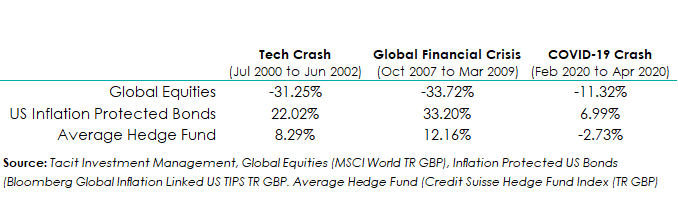

Industry-wide data reveals a sobering truth. In 2008 and again in 2020, most hedge funds failed to protect capital when it mattered most.

Rather than providing the promised uncorrelated returns, they often moved in lockstep with equities, particularly during periods of market stress when their supposed independence would have been most valuable.

A recent Financial Times article highlighted the University of California’s decision to completely divest from hedge funds under Chief Investment Officer Jagdeep Singh Bachher. For a $190 billion institutional investor to walk away entirely represents a significant shift in thinking. For us at Tacit, it reaffirmed a conviction we’ve held since the Global Financial Crisis: complex doesn’t always mean effective when it comes to portfolio risk management.

We’ve never relied on hedge funds to manage risk because we never believed they were the most effective tool for the job.

The problems with hedge funds extend far beyond their correlation failures. Their opaque strategies can amplify losses through leverage. They come with expensive fee structures that eat into returns. They lack liquidity precisely when you need it most. Lock-up periods trap capital during periods of stress. And despite all this complexity and cost, they consistently fail to provide true downside protection when it’s most needed.

Instead of chasing the latest hedge fund innovation, we developed a more transparent and adaptable approach rooted in traditional assets. Our framework combines growth assets with stabiliser assets, a strategy that has delivered stability with better returns over the past two decades with far less drama, complexity, and cost.

Growth assets include equities, defensive equities with stable and lower drawdown profiles, and investment-grade and high-yield credit. These are designed to deliver long-term real capital appreciation, with the understanding that volatility and drawdowns are part of the equation.

Stabiliser assets are selected specifically for their ability to cushion portfolios during market downturns. These typically include cash and developed market government bonds, assets chosen for their reliability rather than their sophistication.

Our approach is built on two fundamental principles: simplicity and transparency.

By constructing portfolios where each asset has a clearly defined role, we create genuine robustness. We balance return-seeking assets with stable, lower-drawdown assets that provide critical ballast during turbulent markets while still contributing positively to long-term returns. This approach helps us avoid both performance surprises and liquidity crises.

The last few years have tested even the most committed bond investors. Yields rose sharply, volatility returned, and many questioned whether fixed income still works as a stabiliser. But history provides the answer: in 2008, 2020, and during recent market volatility, core developed market bonds remained among the few reliable sources of liquidity and protection when equities faltered.

Hedge funds, for all their innovation, have struggled to deliver these attributes consistently.

That’s why we’ve remained committed to our framework: pairing growth assets for return with stabiliser assets for resilience. Our approach, grounded in empirical research and decades of crisis-tested experience, continues to serve our clients well.

When building robust portfolios, we believe in using tools that are proven, liquid, and transparent. In investing, as in life, sometimes simpler really is better.