We’re often asked why, as an active investment manager, we hold a large proportion of our exposures through index trackers rather than actively managed investments. It’s a fair question and in a world where activity is tracked second by second this may look like we’re busy doing nothing.

Our strategies do currently have higher than historic exposure to index trackers at present. This was with the belief that although the environment is more volatile for investors, most will not predict the direction of travel correctly: at times being too pessimistic and at times to optimistic. The risk of missing out on the upside of our historically cheap holdings was more important to us than short term noise driven by newsflow.

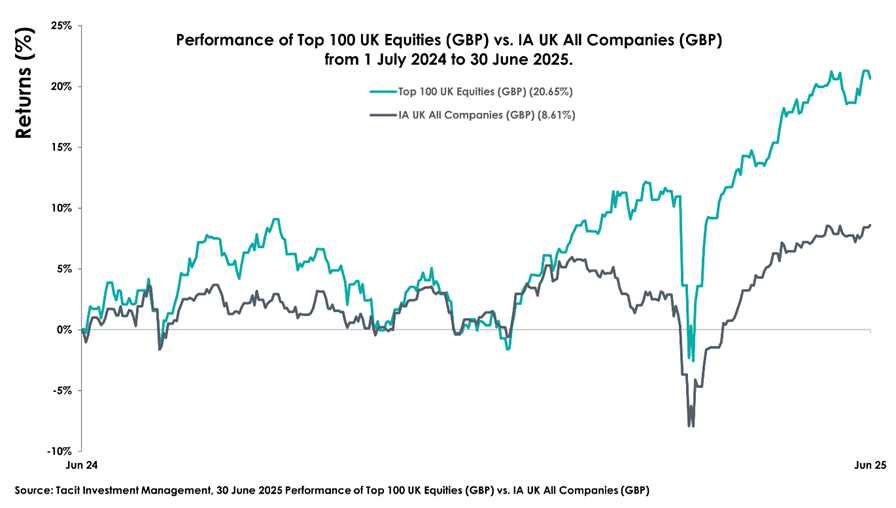

In reality, the past six months should have been an environment where ‘active managers’ earn their fees picking stocks and avoiding those that have been impacted by President Trump’s tariff policies and continued conflicts in Europe and the Middle East. Unsurprisingly to us, as predicting which stock will perform well or badly over the short term consistently is impossible, our index tracking exposure has actually performed better than the average active manager picking UK stocks for example as shown in the chart below.

Just another reminder than being active does not mean that you should trade every day, it is more about owning investments that your analysis shows are cheap and having the conviction to hold your favoured investments through difficult periods such as this year.

Not many investors, be they professionals or individuals, consistently stick to this approach and end up with poor outcomes. This forces our team at Tacit to have stronger convictions about every action we take and reduces trading fees for our clients. We believe high index tracking exposure in client accounts is a sign of our process working rather than the other way around.