The Dot Com bubble which ended in the year 2000 can provide an alternative insight into the recent equity market volatility being experienced by investors and can also illustrate why certain markets have risen whilst the US equity market has come under pressure so far this year. In normal circumstances, a falling US equity market would mean falling markets everywhere.

For context, the US equity market has outperformed most other major markets for over a decade and the recent falls do not come close to reversing this. However, the valuation of the US market is higher than historic averages and significantly higher than all other developed equity markets. This is not unusual as US companies generate higher profits more consistently than their peers.

To us, it has always been about how much you pay for this higher growth, and will this valuation premium be preserved when you come to sell an equity that you bought when it was expensive. Forecasting this is almost impossible as many factors influence the price of an equity from day to day, some rational and many irrational. This is why our strategies have a balance of cheaper exposure and more expensive exposure to the global equity markets through value and growth exposures.

Value stocks and growth stocks represent two distinct investment approaches in the stock market, each with unique characteristics and appeal to different types of investors.

Value stocks are typically associated with established companies that are considered to be trading below their intrinsic value. These stocks often have low price-to-earnings (P/E) ratios, high dividend yields, and low price-to-book ratios. Investors are attracted to value stocks for their potential to increase in price once the market recognizes their true worth, as well as for their stability and dividend payments. Industries such as utilities, financial services, and consumer goods often contain value stocks.

On the other hand, growth stocks are shares in companies with high potential for rapid expansion. These companies usually reinvest their profits back into the business to fuel further growth, rather than paying dividends. Growth stocks typically have high P/E ratios and are expected to outperform the overall market over time due to their future potential. They are commonly found in newer sectors such as technology and biotechnology.

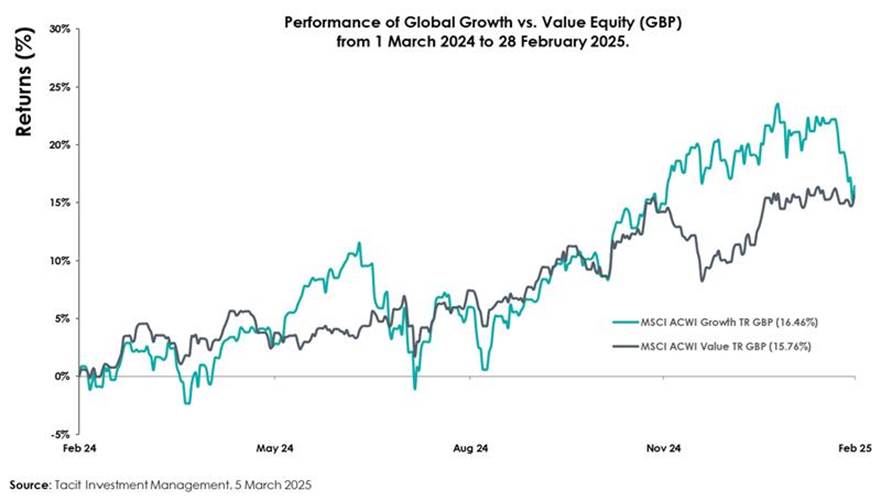

In the economic cycle we have entered, this growth and value distinction has actually become a regional distinction. Growth stocks are a majority component of the US equity market, whilst value stocks are a significant component of European and Asian equity markets. This bias has led to a distinct divergence in recent performance where the US equity market has fallen whilst others have gone up this year to date. The chart below shows that the MSCI World Growth index, which had performed well relative to the value index, has now given back those relative gains as the US equity market has fallen, and Europe and Asia have held up: primarily because they hadn’t risen as much last year and are more value biased.

This leadership change also occurred in the early 2000s and lasted nearly three years. Investors reassessed the risk premia allocated to growth stocks following the rapid rise in their valuations as company earnings did not meet their lofty expectations. This time, President Trump is forcing a reassessment of the risk premia that should be allocated to US equities. Investors will look for cheaper alternatives and we believe this is only the beginning of this process and is just one of the reasons that Tacit strategies have a bigger allocation to Asia and Europe than to the US. This change in market leadership may prove to be the catalyst to make other investors think like us.