When comparing the thousands of funds available in the UK, past performance is often the first thing investors look at. It seems logical: surely a fund with better recent returns must be the superior investment?

The reality is more nuanced. Our analysis shows that most fund managers operate with inherent biases towards new ideas, cash flows, growing dividends, or particular regions. These biases mean performance naturally ebbs and flows as markets shift from favouring one factor to another, driven by changes in the global economic and political landscape.

Recent analysis from Prusik Investment Management LLP, one of our current portfolio holdings, offers a compelling illustration. It demonstrates how a fund owning genuinely solid businesses can alternate between periods of significant outperformance and underperformance without the quality of the fund itself changing.

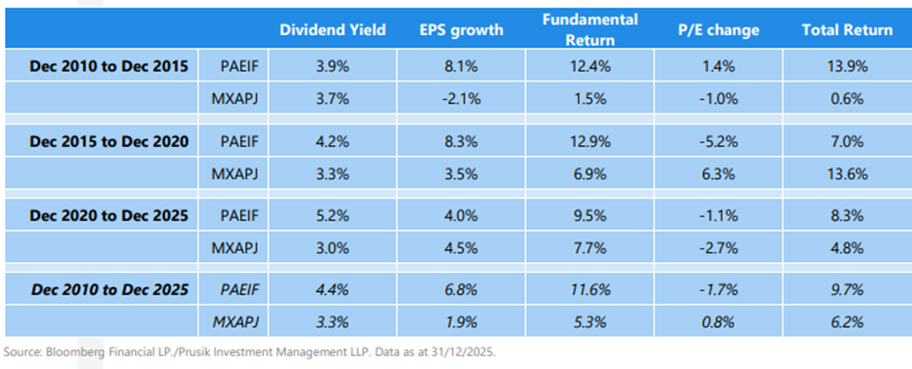

The table above tracks the Prusik strategy (PAEIF) against the MSCI Asia Pacific Index across three distinct five-year periods spanning 15 years. As the table clearly illustrates (right hand column) the strategy performed significantly better than the index in its first five years, significantly lagged the index in the middle five years and has significantly outperformed the index in the most recent five-year period to the 31st December 2025.

This analysis reminds us that investment returns comprise various factors, some within a company’s control and others entirely beyond it.

The table reveals the dividend yield and the company’s earnings per share growth combine to show that the fundamental return from the underlying strategy was ahead of the MSCI index in each of the three periods. It was actually the change in the price-earnings (P/E) multiple which resulted in the fund underperforming in the five years to the end of 2020. In other words, the prevailing market environment determined the actual returns investors received, regardless of the underlying quality.

Consider the position of an investor reviewing this fund in early 2021. After five years of underperformance relative to the index, it is unlikely you would invest in a fund that had performed so poorly relative to the index. Why not simply opt for a cheaper index tracker instead?

This is precisely where the Tacit process adds value. We work to align the prevailing economic and political environment with investment strategies we believe will perform best in that environment. In practice, this meant investing in the Prusik strategy in 2021, before market conditions shifted back in its favour. Most investors struggle to make such decisions with conviction because they lack a deep understanding of the underlying investment strategy and approach, an approach that may well change following a period of poor performance.

This example demonstrates how Tacit’s research process and direct access to managers running strategies at firms like Prusik has proved invaluable in today’s evolving investment landscape.