Tacit has always employed a value-driven approach to our investment selections, though this does not necessarily present itself when you look at our strategies at headline level. In reality, value can mean buying investments that appear cheap compared to history, or investments that appear cheap in relation to their future potential. The latter of these is reliant on extrapolation into the future whilst the former relies on history repeating itself. Both come with risks, that’s why investing is not a simple game and most underperform.

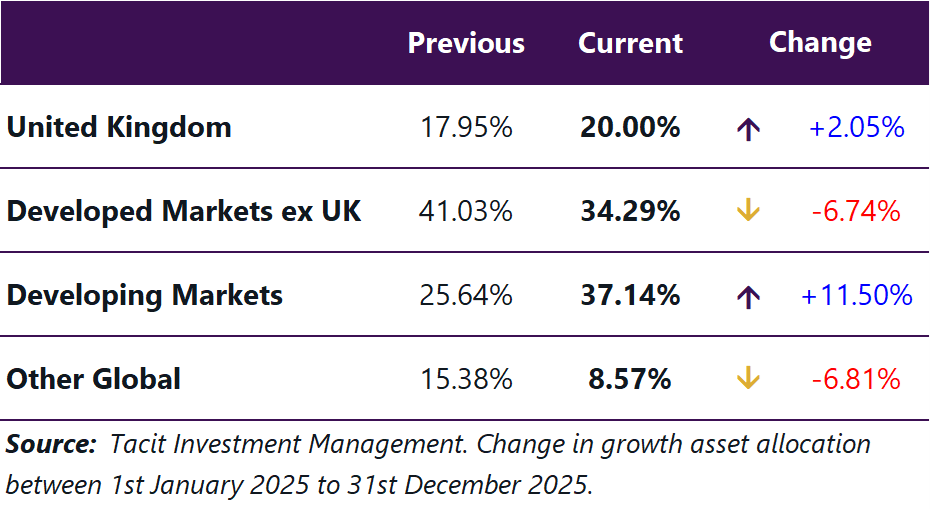

As we entered 2026, the balance between these two strands of value investing has not been wider. US equities remain expensive in the context of history whilst other markets appear very cheap. As the table below illustrates, our approach is actually leading to a further bias away from the US equity market moving forward for some very significant reasons.

Value investors can make a strong case for structurally overweighting non‑US, particularly in Asia, given wide valuation gaps and a very different sector mix versus the US. For UK clients this often means tilting gradually towards international cyclicals rather than making explicit top‑down market calls.

From a value perspective, US equities still trade on elevated multiples after a multi‑year, AI‑driven rally, which leaves traditional value pockets relatively scarce compared with international markets. By contrast, Asian stocks generally offer lower price‑to‑earnings and price‑to‑book ratios, alongside improving earnings momentum and shareholder‑return policies, so the effective margin of safety is often more attractive abroad.

Another important reason to tilt towards non‑US markets is sector composition. Non‑US benchmarks are less dominated by mega‑cap technology, and Asia in particular has heavier weights in financials, industrials, materials, energy and export‑oriented manufacturers. In many Asia value and Asia ex‑Japan strategies, portfolios are skewed away from high‑multiple information technology and communication services towards cyclicals and defensives such as banks, industrials, consumer staples and utilities. These businesses are closely tied to credit cycles, infrastructure and capital expenditure, global trade volumes and domestic demand, which gives value investors several potential cyclical and structural re‑rating paths as conditions normalise.

The macroeconomic backdrop moving into 2026 further supports this stance. Emerging Asia enters the year with relatively solid growth, lower leverage and more policy flexibility than many developed economies, which underpins earnings recovery in cyclical sectors. A softer dollar and the prospect of rate cuts in parts of the emerging world improve local financial conditions, benefitting banks, property‑related names and domestically focused cyclicals. At the same time, under‑ownership of emerging and Asian equities, coupled with ongoing reforms and capital‑market development, creates scope for both sentiment and valuation catch‑up. For UK clients, the overweight to non‑US and Asian cyclicals need not be presented as a bold regional bet. Instead, it emerges naturally from bottom‑up selection grounded in valuation, balance‑sheet strength and cash‑flow durability. Over time, portfolios tilted towards Asia and selective emerging‑market managers actually provide a superior risk-reward profile without compromising upside potential.