Sometimes, it can seem as though the political landscape doesn’t influence Tacit’s investment thinking. Political developments naturally form part of our broader economic analysis, however, we maintain a disciplined focus on fundamental drivers when making medium-term investment decisions. Short-term political news flow often generates market volatility as investors react to daily headlines and commentary, but this noise typically has limited bearing on our strategic positioning.

We recognise that politics can influence the investment landscape, but we prioritise factors with more predictable and measurable impacts on long-term value creation. Political events matter most to our process when they translate into concrete policy changes that materially affect economic fundamentals, a threshold that is rarely met by the constant stream of political commentary and speculation that captures market attention in the near term.

Our investment philosophy is rooted in one fundamental principle: buying company cash flows. When you purchase an equity share, you’re acquiring ownership in a real business and its future profits. We believe that disciplined investment should be grounded in measurable and consistent economic principles, which leads us to a simple but powerful conviction: companies that consistently grow their profits and cash flows over time will become more valuable, and their share prices will eventually reflect this growth.

“There is a 100% correlation between what happens to a company’s earnings over several years and what happens to the stock price.” Peter Lynch, 1993

This concept was famously articulated by Peter Lynch, the former manager of the Fidelity Magellan Fund, which was the largest mutual fund in the world at the time. During his 13-year tenure from 1977 to 1990, Lynch delivered an exceptional 29.2% average annual return, transforming the fund from $20 million to over $14 billion in assets. His success stemmed from a steadfast focus on fundamental business performance rather than market noise.

Lynch observed that there is a strong correlation between what happens to a company’s earnings over several years and what happens to its stock price.

Correlation measures the relationship between two or more variables on a scale from -1.0 to 1.0. A correlation of 1 indicates perfect positive correlation, meaning both variables move in lockstep. A correlation of -1 indicates perfect negative correlation, where one variable rises as the other falls. A correlation of 0 means no relationship exists between the variables. For example, as President Trump discovered, egg prices correlate with egg supply: when supply falls, prices rise.

While Lynch spoke of a “100% correlation” between earnings growth and stock price performance, perfect correlation is unlikely in practice. However, the reality comes remarkably close to his assertion. This demonstrates that focusing on cash flow growth, something companies can control and improve, provides a far more reliable path to long-term investment success than betting on external conditions beyond investors’ control. A strong correlation is more than sufficient to guide disciplined investment decisions.

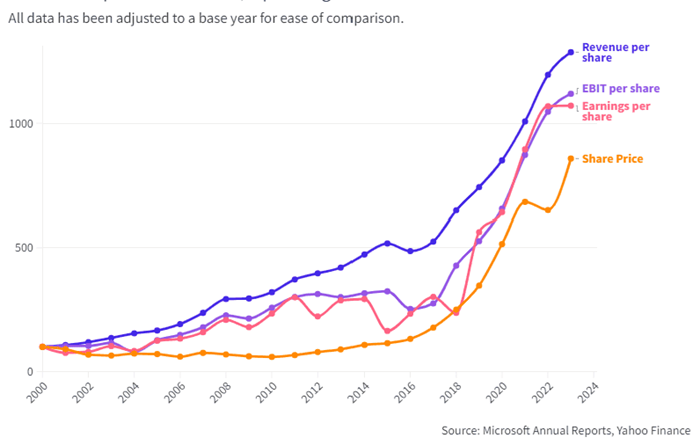

The chart below illustrates how the Microsoft share price has tracked earnings over the past 25 years.

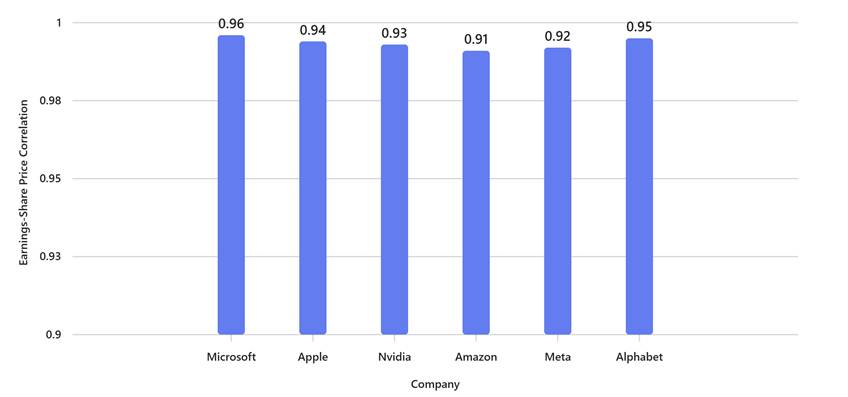

The correlation is actually 0.96 (96%), which is not far off Lynch’s 100% assertion. If we perform the same analysis for the 6 largest stocks in the S&P 500 at the end of 2024 (Nvidia, Microsoft, Apple, Amazon, Meta, and Alphabet), the correlations are above 0.90 for all of these stocks. This clearly shows it is their earnings and cash flow growth which matters over time, not other factors.

Source: NYSE

Tacit portfolios combine two complementary components: core holdings in companies that consistently grow their profits and cash flows, alongside value opportunities in quality businesses temporarily mispriced due to geopolitical or economic conditions. This balanced approach allows us to look beyond short-term market noise and explains our comfort holding the largest US technology companies despite historically expensive valuations. The key question isn’t whether these stocks are expensive relative to their past, but whether their future earnings justify current prices.

Federal Reserve decisions and geopolitical tensions create noise and opportunity, but don’t alter our fundamental thesis. For disciplined investors focused on cash flow growth, the current market offers compelling opportunities across both core growth holdings and undervalued quality businesses, positioning portfolios favourably for long-term success.