For over 15 years now Tacit Investment Management has pioneered a unique approach to investing which can appear simplistic to the naked eye: buying investments to explicitly grow your capital in real terms (Growth) alongside investments to manage the risk of a market fall in any year (Stabilisers). This two bucket approach seems intuitive to most but not many, if any, of our peers invest in this way.

Our job day to day is to manage each of these two components to generate “REAL” positive returns after inflation and charges.

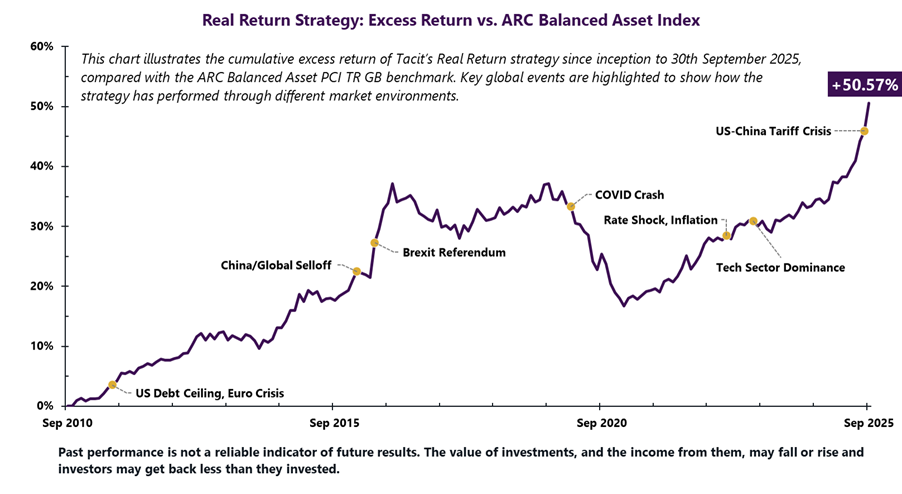

During the last decade and a half many events have occurred which could have derailed our approach. The list below highlights a few of these events coupled with the effect on equity and bond markets at the time. Each of these events did, at the time, raise anxieties for our clients but are now looked back on as opportunities as portfolio values have risen materially since each event.

| Year | Event/Theme | Market Impact (Equity) | Market Impact (Bond) |

| 2011 | US Debt Ceiling, Euro Sovereign | US & EU equity turbulence | US/EU yield drops, credit shock |

| 2015–16 | China/Global Selloff | Global equity losses | Credit spreads widen |

| 2016 | Brexit Referendum | UK/Europe equities volatile | Pound, UK gilts adjust sharply |

| 2020 | COVID Crash and recovery | Fast bear, then bull | Yields plunge, bond rally |

| 2022 | Rate shock, inflation | Tech stocks/indices fall | Bond losses, higher yields |

| 2023 | Tech sector dominance | “Magnificent Seven” lift US | Volatility, policy uncertainty |

| 2025 | US-China tariff crisis | Global equities drop sharply | US Treasury volatility spike |

Our active approach to the management of the ‘Growth’ and ‘Stabiliser’ during these phases can sometimes go unnoticed but is important to highlight. For example, coming into 2022 we had sold out of longer dated government bonds in the Stabiliser as we were concerned about the asymmetric risks in the government bond markets at that stage with yields near zero and inflationary risks building. It would not have been helpful to client outcomes if, as equities fell in the second half of 2022, the Stabiliser also lost value as it was rising inflation that was actually the risk to both elements of our strategies. Our active approach led us to actually buy government bonds after the short-lived experiment that was Trussonomics as many were running for the hills.

History shows that it is easy to follow the crowd, but only a structured, disciplined process results in positive real returns over time. When we founded Tacit in 2010, in the aftermath of the Great Financial Crash, our aim was to look after our clients’ capital in a transparent way whilst providing a first-class personal service. Much has changed over these last fifteen years but our dedication to achieving these goals remains the same.

So in a week when we proudly received the Citywire Wealth Manager Investment Performance Award 2025 for the risk-adjusted returns of our Total Return strategy over the past three years, we leave you with the below chart showing how our Real Return Strategy (the truest blend of our Growth and Stabiliser approach) has consistently outperformed our peers over the past 15 years.

Source: Tacit Investment Management. Performance is based on Tacit’s model portfolio, calculated on a total return basis with income reinvested, net of fund charges and Tacit/AJ Bell fees (0.75% p.a.), but gross of advice fees and VAT Benchmark performance is total return. Returns may differ from individual portfolios due to timing, platform differences, and fees. All figures in GBP.

We will write over the coming weeks about the various risks we see within the building blocks of our strategies moving forward with some thoughts on how we are managing exuberance on the one hand (Growth) with excess pessimism in the other (Stabiliser).